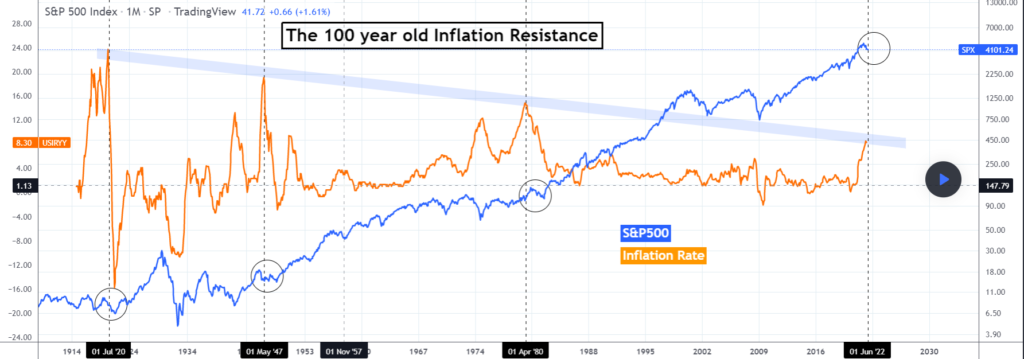

According to TradingShot from Tradingview, the Inflation Rate (orange trend-line) is testing a 100 year old trendline. The last time it was there was the around April 1980!

This all started back in July 1920 where the reading was around 24. The next lower high came in around 1947 in May at around 20. Connecting the two points, you get a downward sloping trendline. The next time inflation rate touch the trendline was in April 1980 and now we have touched it again.

How Will Inflation Affect the Stock Market?

If the past is going to repeat itself like the previous 3 times, then we should see a multi-year bear market.

Keep in mind, having inflation rate at these high levels is not the only factor that can cause a bear market, ie the stock market crash of 2000, and 2008 are recent prime examples.

What is important to note, is that after the July 1920 inflation spike, the stock market has had the biggest market crash in history, and that is the 1929 market crash where the market dropped 80% from its all time highs. This market event could happen this time and could even be much bigger.

How Do You Prepare for a Stock Market Crash?

- Decrease your market exposure. You can’t lose what is not at risk. Remember the fast crash in of 2020? Imagine if you had gone to cash and bought back near the lows. You would have made significantly increased your net wealth. If this is too risky of a play, you can always stay in cash and just step aside.

- Increase cash reserves. If you are low in cash and don’t have an emergency fund of at least 6 months, then it is imperative that one make an effort to build up cash reserves. This allows for piece of mind when unforeseen bad events happen in life, and you have cash to make the bad times pass on an easier level. Be the squirrel that prepares for a harsh and low winter.

- Increase ownership of real assets. If you read history on catastrophic economic events from around the world, you’d see that it pays to have actual commodities to trade when times get tough. Precious metals such as silver and gold and common ways to hedge against market crash. If you have real estate that is already paid off then it’s also a huge plus.

- Learn to trade and make money on the crash! Don’t pigeon hole yourself to thinking that you can only make money while the market goes up. Realize your risk tolerance and learn to profit by shorting common stock, buying inverse ETFs, or trading put options. Like any skill, trading will take time to learn, but it’s definitely worth your while because it will protect your net worth especially in before and during a stock market crash. Don’t be a fool and do nothing during a crash like traditional wisdom suggests.

The stock market is just a community of buyers and sellers represented on a chart. Learn to trade this chart and take control of your destiny.